For many UK organisations, particularly those in the mid-market, Making Tax Digital represents a fundamental shift in how financial data is captured, managed, reviewed and submitted.

While the regulatory driver comes from HMRC, the real challenge for finance leaders is not compliance itself, but how to embed digital tax processes into day-to-day operations without creating unnecessary friction, risk or cost.

The businesses that struggle most with Making Tax Digital tend to view it as a narrow reporting obligation. Those that succeed take a broader view, using Making Tax Digital as a catalyst to simplify finance processes, improve data quality and reduce manual effort across the organisation. Below are five practical, holistic ways businesses can simplify Making Tax Digital adoption while strengthening financial operations at the same time.

1. Standardise Financial Processes Before Digitising Them

One of the most common mistakes businesses make when preparing for Making Tax Digital is digitising complexity. If financial processes vary by department, location or individual, layering digital tools on top simply hard-codes inefficiency.

Before focusing on software, finance teams should take time to map and standardise core processes such as purchase invoicing, expense management, revenue recognition and VAT treatment. This does not need to be a full finance transformation programme, but it does require clarity on how transactions flow from source to submission.

Standardisation delivers three immediate benefits for Making Tax Digital adoption. First, it reduces the number of edge cases that cause reporting errors. Second, it makes digital record-keeping far more straightforward, as data is structured consistently. Third, it improves internal understanding of how tax-relevant data is created, which is essential when quarterly updates and audit trails become the norm.

For mid-market businesses, this step often highlights long-standing reliance on spreadsheets, workarounds and informal approvals. Addressing these early removes friction later, particularly when systems must produce digital links and near-real-time figures.

2. Treat Data Quality As A Governance Issue, Not An IT Task

Making Tax Digital places sustained emphasis on the accuracy, consistency and traceability of financial data. Quarterly submissions and digital links mean errors surface faster and are harder to mask. As a result, data quality can no longer be treated as a technical issue owned solely by finance systems or IT teams.

Simplifying adoption requires clear ownership of financial data across the business. This includes defining who is responsible for data at source, how errors are identified, and how corrections are made without breaking audit trails. Chart of accounts structures, VAT codes, customer and supplier records all need consistent governance.

Businesses that formalise data ownership often find Making Tax Digital becomes easier to manage because fewer corrections are needed downstream. It also reduces dependency on key individuals who previously held knowledge in their heads or personal spreadsheets.

This approach aligns closely with broader financial control and risk management objectives. Making Tax Digital is simply the forcing function that exposes weaknesses in data discipline that already exist.

3. Align Making Tax Digital With Existing Reporting And Decision-Making Cycles

Another common pitfall is treating Making Tax Digital reporting as an additional task layered on top of existing month-end and management reporting cycles. This often results in duplicated effort, rushed reconciliations and disengagement from finance teams who see Making Tax Digital as administrative overhead.

A more effective approach is to align Making Tax Digital submissions with existing financial rhythms. Quarterly updates should be a by-product of robust monthly close processes, not a separate exercise. When management accounts, VAT reporting and tax submissions draw from the same underlying data set, compliance becomes significantly easier.

For mid-market organisations, this often means rationalising reporting tools and reducing parallel data sets. If management reports are built in spreadsheets that differ from system records, Making Tax Digital will expose those inconsistencies. Using a single source of truth for operational, management and statutory reporting reduces effort and improves confidence in the numbers.

The added benefit is cultural. When finance teams see that Making Tax Digital data supports commercial decision-making, rather than distracting from it, adoption becomes far less painful.

4. Invest In Capability, Not Just Compliance

Making Tax Digital is frequently approached as a compliance deadline rather than a capability shift. Training is often limited to how to submit returns, rather than how digital finance processes should work end-to-end. This creates reliance on a small number of specialists and increases operational risk.

Simplifying adoption means investing in broader financial capability. Finance teams need confidence in digital workflows, automated reconciliations and exception-based reviews. Operational teams that input data should understand why accuracy matters and how errors propagate.

This does not require turning every employee into a tax expert. It does require clear guidance, role-appropriate training and documented processes that survive staff turnover. Businesses that do this well find Making Tax Digital reporting becomes routine rather than stressful.

From a leadership perspective, this approach also supports succession planning and scalability. As reporting becomes more frequent and transparent, resilience in finance operations becomes a competitive advantage.

5.Choose Platforms That Support Making Tax Digital As Part Of A Wider Finance Strategy

The final, and often decisive, factor in simplifying Making Tax Digital adoption is the choice of finance platform. Many organisations attempt to meet requirements by bolting Making Tax Digital – compatible tools onto legacy systems. While this can work in the short term, it often increases complexity, integration risk and ongoing cost.

Mid-market businesses in particular benefit from platforms that treat Making Tax Digital as a native capability rather than an add-on.

Systemising Tax Management: A Route To Growth

Systems that maintain digital links, automate VAT and tax logic, and provide real-time visibility significantly reduce the operational burden of compliance.

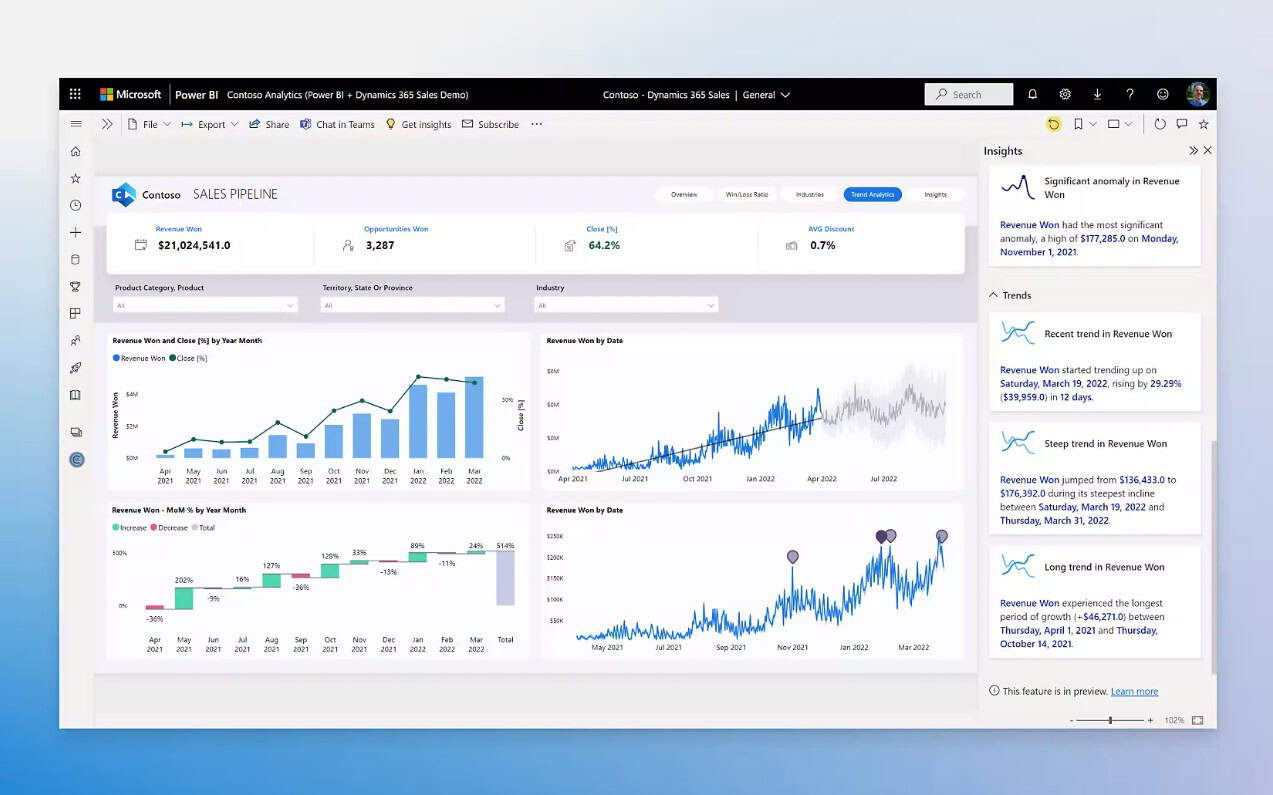

This is where solutions such as Microsoft Business Central are increasingly relevant. Rather than positioning Making Tax Digital as a standalone problem, Business Central supports digital tax requirements within a broader finance, operations and reporting framework. This allows finance leaders to address compliance while also improving forecasting, cash flow management and financial control.

When positioned correctly, Making Tax Digital becomes one outcome of a modern finance platform, not the sole reason for investment. For organisations balancing regulatory pressure with growth ambitions, that distinction matters.

Businesses that simplify adoption focus less on ticking boxes and more on strengthening processes, data governance and financial capability. Those foundations make compliance easier today and future change far less disruptive.

For more around solutions for managing tax digitally, please get in touch:

Contact Us